Why use a clearing account?

If you don't use a clearing account, QuickBooks or Xero may show duplicate settlement entries. These entries come from: 1. Rotessa (Integration) 2. Your bank account (bank feed)

How this happens

Rotessa integrates with QuickBooks Online and Xero by syncing transactions to match invoices created in the accounting software.

- When the invoice created from the integration is imported, it creates a corresponding transaction in Rotessa based on the due date of the invoice.

- However, the invoice will still show as unpaid until the Rotessa transaction is processed and marked as paid via the integration.

- Once the payment is approved, the invoice is marked as paid in the integration, and the funds are deposited into your bank account.

If you have a bank feed connected to the integration (automatic import of transaction data)

from your

e.g. business chequing account

and

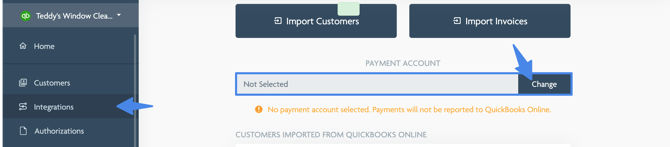

If your PAYMENT ACCOUNT is set to the same account as where your bank feed records transactions

In your accounting software, you will receive individual entries from Rotessa for each paid invoice, and the funds deposited from Rotessa to your bank account will appear in the account as a single lump sum for that settlement period, even though it may cover many individual invoice payments.

- These will appear as duplicate entries, one from the bank feed and one from the Rotessa integration.

- This can clutter the bank register with many individual line items for each invoice payment, all tied to a single bank deposit.

To avoid this

Set the PAYMENT ACCOUNT to direct payment records to an Undeposited Funds or Clearing Account

This can be called 'Rotessa clearing account' or something similar.

- This keeps the payment records out of the bank register.

- Once the lump sum deposit appears in the bank feed, users can match it to the group of payments recorded in the clearing account.

- This preserves one-to-one invoice payment tracking while keeping the bank register clean and accurate.